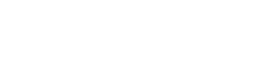

Best practices for improving billing and collections processes for solo BCBAs and ABA Therapy providers with multiple therapists.

A few weeks ago, we talked about the mantra “bill early and often.” Now we are going to dive into the second part, “dial for dollars,” and how that applies to ABA Therapy Billing and Collections Best Practices.

Let’s face it, effective billing practices are 80% of your battle to get paid for your services. If you have nailed those efficiencies, you’ve got money coming in the door. But what about the other 20%? Over time, that can be a large sum of money eroding at your bottom line.

Dial for Dollars

Initial follow up

- I refer to this as soft collections. This is where you set up practices that ensure that your billing has arrived and is in process. For insurance funding sources, they have NO motivation to ensure that your claims are in process. You can refer to this as the soft collect and perhaps assign it to an administrative staff member who does not necessarily have the collection experience that you might need for complex claims issues. But don’t skip this step! It will also help to ensure that you are catching timely filing issues before waiting around for an EOB to show you that something was skipped.

- Set up online logins for as many insurance companies as possible, and 2 weeks after you have submitted claims, check that they show in process online.

- Call on those that you have no online login for. Sometimes you can get information from the automated call responses.

- If you find that your claims have NOT been received, send them again! For non-electronic claims, it is difficult to prove timely filing. So if you are mailing or faxing and they are not in process within 2 weeks, send again! Especially if you faxed a batch of claims and the others are showing in process. Fax issues are not uncommon and the worse thing that can happen is that they find both sets and process the 2nd one as duplicate.

- Make notes of the actions you have taken in this step so other team members know what you’ve done on this claim or so you know yourself if you have to come back to it in future steps.

Payment Application—Basic Processes

Payment Application—Basic Processes

- I can’t begin to express how crucial this step is. If you don’t have a process to apply payments to what was billed, you will lose money. This is what we call “low hanging fruit,” tasks that can be done immediately to bring in cash flow.

- The person who is applying payments in your company is at the control center for notifying billing or collections if something shows amiss on an EOB.

- If you don’t have practice management software that can track payments against what was billed, you need to use Excel, Access, or find an alternative way to track in your accounting software. You can’t leave this to chance. Yes, you got our billing out the door and they processed it. But remember—that 20% of incorrect payments can add up over time.

- Know your billing methods per funding source. Are you billing fee schedule or contracted rate? If you are billing fee schedule, don’t panic if you have an adjustment. This is to be expected. Billed charges will = fee schedule and Allowed charges will = contracted rates. In the case of out of network, allowed charges will represent reasonable and customary and you can balance bill parents the difference. We’ll discuss that in a later step.

- Set up tie out procedures to tie out what you have posted to your software back to the total of the checks that you have applied. These simple housekeeping tasks for billing and collections that are handled on the front end on a daily basis will support you in running month-end, quarter-end, and year-end reports for your tax accountant.

- If you get an overpayment from the insurance company, investigate and then be prepared to pay back. You can wait for a recoupment request or you can generate a check with copies of the supporting documentation and send back to them immediately. This happens on occasion and if you wait for the recoupment request and then ignore it or stall on it, they will take it from a future payment and that can cause issues in future account reconciliation.

Payment Application—Incorrect Payments

- We all know the pain of not being paid correctly even with perfect billing.

- Skipped payments

- If you missed this back in the soft collection stage and you see a missed date range, you need to get the claims sent to the insurance plan as soon as possible (remember timely filing).

- Short payments

- Evaluate the short payments, did you bill incorrectly? If so, process an adjustment during the payment application.

- Processing as out of network in error

- Pay close attention to those co-insurance % that are showing on our EOBs. You can usually quickly see that something was processed as out of network when it shows 60 or 70% when you were expecting 80 or 90% based on your eligibility call.

- You need to cash the check and apply the payment and then make a call to the insurance company for this error. We’ll discuss this in a later step.

- Skipped payments

Parent Billing and Collections

- Immediately after posting payments, you need to generate your parent statements or invoices.

- If the benefit has a daily copay, you can issue those invoices as you prepare billing, but if there is a deductible or co-insurance involved, you need to wait for the EOB from the insurance company before billing.

- Parents are receiving copies of the EOBs as well so there should be no surprises. Because deductibles and out of pocket max limits are shared across other benefits, you need to wait on the EOB to know how to accurately invoice parents.

- Set up a terms policy with parents as to when the payments are due. Be clear on the outcome if payments are not made in a timely manner.

- You cannot write off insurance deductible and co-insurance. Members are liable for that portion of your fees. You can however, decide not to bill the difference between reasonable and customary and your fee schedule in an out of network situation.

Collection Process—Dialing for Dollars!

- Finally, we are into the heavy lifting! Whew, that’s a lot of work to get to this point but all so very important.

- The following are tips for getting the best outcome for your collection processes:

- You can use current EOBs to make a call on a new issue, but always work the whole account. If you are calling on a past due issue, review the full account and get status on ALL of the outstanding claims.

- Don’t rely only on the automated system. That works for the soft collect, but you need a live person if you are at this stage.

- Be assertive in your collection calls, but don’t be aggressive, confrontational, or belligerent. Kindness will get you farther; collect in a customer service manner.

- Allocate a certain amount of time each week or month to addressing and resolving smaller older balances because the collection success rate drops dramatically once balances become more than 120 days past due.

- Keep detailed notes and keep an organized system on when to follow up on claims and prior phone calls with claims that have been reprocessed. Schedule follow up calls on a calendar to keep things from falling through the cracks.

- If you have exhausted all resources with claims reps and supervisors, use your notes and file an appeal. Give detailed information on the issues and provide documentation to support your claim. Schedule follow ups on appeals just like you do regular collections.

- Don’t give up!

Reports

- If you are using practice management software and posting payments timely, you can run weekly or monthly aging reports and track progress, compare to prior reports, and find focused areas to task your collection team with.

There’s no reason you shouldn’t be collecting 100% for your services. If you are doing all you can and just can’t seem to keep up, we completely understand. There are many detailed steps involved in the initial billing and the follow up that is necessary to get that 100%. If you need help, give us a call! Collections is one of our specialties. We take it very seriously and want nothing more than to help get your payments in the door. If you would prefer to keep billing and collections in-house, we also offer in-house training and supervision. And no provider is ever too small. Call (520) 800-4740 or email info@www.ababilling.net for more details today!